IN Chase Select International Private Loan Application/Promissory Note and Credit Agreement 2009-2026 free printable template

Show details

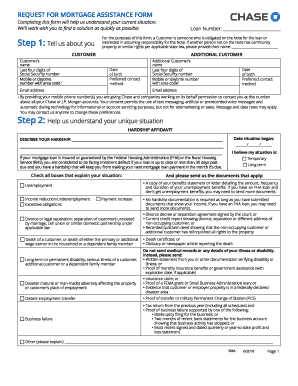

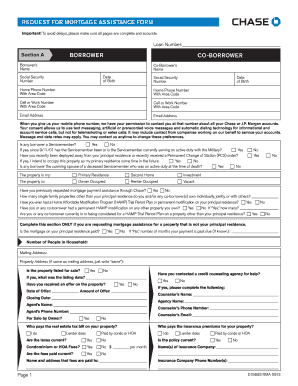

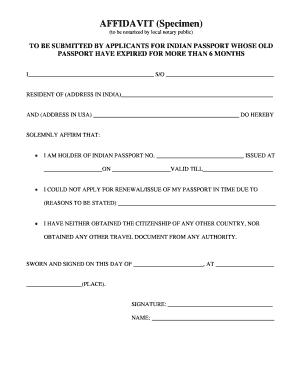

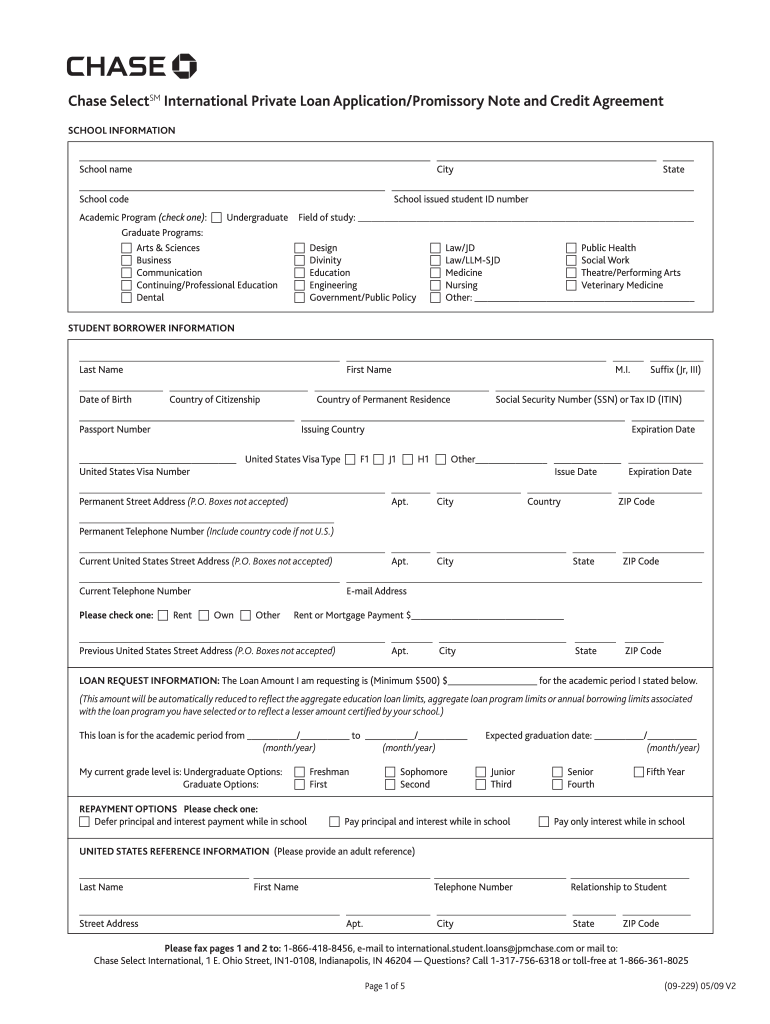

Chase Selects International Private Loan Application/Promissory Note and Credit Agreement SCHOOL INFORMATION School name School code Academic Program (check one): c Undergraduate Graduate Programs:

pdfFiller is not affiliated with any government organization

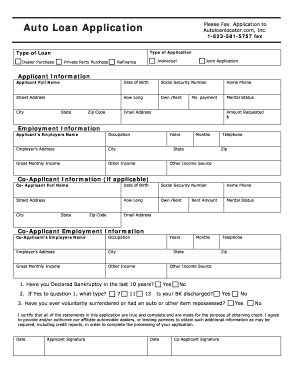

Get, Create, Make and Sign chase personal loans form

Edit your chase loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your chase bank application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit chase personal loan application online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit chase credit application form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out chase mortgage application form

How to fill out IN Chase Select International Private Loan Application/Promissory Note

01

Gather all necessary personal information, including your name, address, and Social Security number.

02

Provide details about your educational institution, including the name, address, and enrollment status.

03

Indicate the amount of loan you wish to apply for and select your desired repayment terms.

04

Fill in financial information, including income details and any existing debts.

05

Include information about your co-signer if required, including their financial details and credit information.

06

Review the loan terms and conditions thoroughly before signing.

07

Sign and date the application where indicated.

Who needs IN Chase Select International Private Loan Application/Promissory Note?

01

International students seeking financial support for their education in the U.S.

02

Students without access to federal loans due to their non-U.S. citizenship.

03

Individuals who require additional funding to cover educational expenses.

Fill

chase bank apply for loan

: Try Risk Free

People Also Ask about chase bank personal loan application

Can I get a personal loan from Chase bank?

Chase Bank does not currently offer personal loans. However, if you're looking for a loan, you may be eligible for financing through other online lenders and banks.

Does Chase bank offer loans?

Unlike traditional loans, with My Chase Loan there's no need for an application, credit check or a separate account to manage. My Chase Loan allows you to borrow money from your existing card's available credit.

What types of loans are available at Chase bank?

Types of Loans Offered by Chase Mortgages. Home Equity Lines of Credit (HELOCs) Car loans. Credit cards. Commercial lines of credit. Business equipment financing.

Can I borrow loan from Chase bank?

Chase Bank does not currently offer personal loans. However, if you're looking for a loan, you may be eligible for financing through other online lenders and banks.

How long does it take for Chase to approve a loan?

If not, you will most likely receive a decision within 7-10 business days. In some cases, however, it can take Chase up to 30 days to make a ruling. After applying, you can check your status over the phone at (888) 609-7805. At the moment, there is no option to check the status of your application online.

Why doesn t Chase bank do personal loans?

The most likely reason why Chase doesn't offer personal loans is that personal loans are not profitable enough for the bank. Chase also offers other products to meet the borrowing needs of consumers and businesses, including a wide range of credit cards, auto loans and home loans.

What types of loans are available at Chase?

Types of Loans Offered by Chase Mortgages. Home Equity Lines of Credit (HELOCs) Car loans. Credit cards. Commercial lines of credit. Business equipment financing.

What credit score do you need for Chase loan?

For most Chase credit cards, you need at least good credit to be approved, which is a credit score of at least 670. A score of 740 or higher bumps you into the “very good” credit range and gives you an even stronger chance at approval.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get chase application?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the chase home mortgage application in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I make edits in how to apply for a loan at chase bank without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing apply for a loan chase bank and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I fill out the chase bank loans form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign chase personal loan application process and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is IN Chase Select International Private Loan Application/Promissory Note?

The IN Chase Select International Private Loan Application/Promissory Note is a legal document used by borrowers to apply for and agree to the terms of an international private loan offered by Chase.

Who is required to file IN Chase Select International Private Loan Application/Promissory Note?

Individuals seeking to obtain a private loan from Chase for international education or related expenses are required to file the IN Chase Select International Private Loan Application/Promissory Note.

How to fill out IN Chase Select International Private Loan Application/Promissory Note?

To fill out the application, borrowers must provide personal information, financial details, school information, and the purpose of the loan. Clear instructions are typically provided on the form.

What is the purpose of IN Chase Select International Private Loan Application/Promissory Note?

The purpose of the application/ promissory note is to formally request a private loan for international studies and to establish the borrower's commitment to repay the loan according to the stated terms.

What information must be reported on IN Chase Select International Private Loan Application/Promissory Note?

The information that must be reported includes the borrower’s personal details, social security number, loan amount requested, educational institution details, cosigner information, and financial information regarding income and expenses.

Fill out your IN Chase Select International Private Loan ApplicationPromissory online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Chase Bank Personal Loans Online is not the form you're looking for?Search for another form here.

Keywords relevant to chase loan

Related to apply for a loan at chase bank

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.